To achieve long-term returns through capital growth by investing primarily in common stocks, or investments that can be converted into common stocks, of large companies listed on major U.S. exchanges and that are located in the United States.

Minimum Initial Investment:

Lump Sum

Initial: $500

Subsequent: $100

| Inception Date | Sep 1, 2005 |

|---|---|

| Fund Code | ATL027 |

| Assets Under Management ($000) As at : 03/28/2024 | $543,529 |

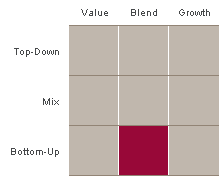

Style

| 3 mo | 6 mo | YTD | 1 yr | 3 yrs | 5 yrs | 10 yrs | Since Inception |

|---|---|---|---|---|---|---|---|

| 8.4% | 21.6% | 8.4% | 25.2% | 8.0% | 12.2% | 11.4% | 6.6% |

As at: 03/28/2024

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|

| 20.1% | (19.6%) | 25.1% | 18.70% | 32.3% | (3.1%) | 24.3% | 2.8% | 5.9% | 9.2% |

Value of $10,000 invested since inception

The rate of return or mathematical table shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the fund or returns on investment in the fund.

†Please refer to the Annual/Interim Management Reports of Fund Performance for further details.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Renaissance Investments family of funds simplified prospectus before investing. The indicated rates of return are the historical annual compounded total returns for the class F units including changes in unit value and reinvestment of all distributions, but do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual fund securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer, nor are they guaranteed. There can be no assurance that a money market fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment will be returned to you. The values of many mutual funds change frequently. Past performance may not be repeated.